This Defense Stock Has a 90% Win Rate Starting Feb. 12

Northrop Grumman dominates autonomous satellite technology – and seasonal patterns reveal the perfect entry point

Editor’s Note: Space is no longer the final frontier – it’s the next great market.

Right now, 22,000 miles above our heads, autonomous robots are docking with decades-old satellites, extending their lives and keeping billions of dollars worth of infrastructure operational. No astronauts or mission control; just AI-powered systems rewriting the economics of space.

My colleague Keith Kaplan from TradeSmith has been tracking this transformation closely, and today he’s sharing some compelling opportunities in the space economy. But what makes this particularly timely is that Keith’s team has just uncovered what they’re calling their biggest financial breakthrough in 21 years – a new approach to timing the market’s largest moves with remarkable precision.

They call it “green day” investing. Since going live in 2025, this strategy has helped investors double their money 13 different times. And the space stocks Keith discusses below are exactly the kind of opportunities this system is designed to capitalize on – high-conviction plays with identifiable timing windows that can amplify your returns.

Read on for Keith’s full analysis, then watch TradeSmith’s Prediction 2026 event to see how this new timing approach could help you navigate what’s shaping up to be one of the most unusual – and potentially profitable – market environments in modern history.

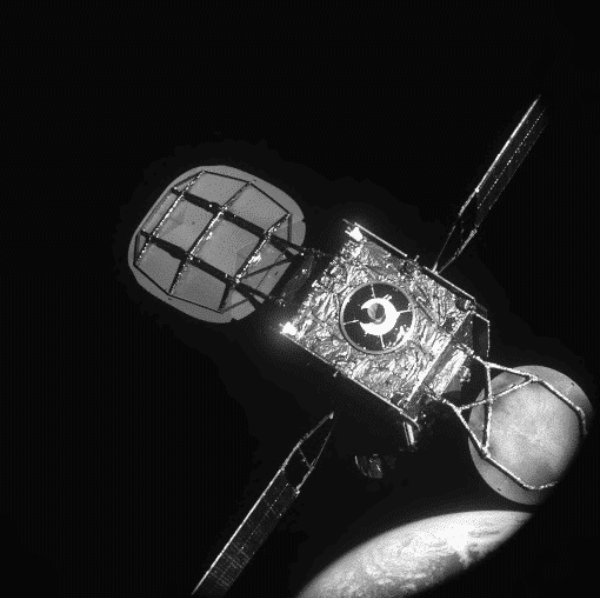

On Feb. 25, 2020, more than 22,000 miles above Earth, a refrigerator-sized spacecraft eased toward a satellite that had been in service since the Clinton administration.

Intelsat-901 sat in geostationary orbit, circling the planet once every 24 hours at the same speed as Earth’s rotation.

From its fixed position over the planet, it relayed TV broadcasts, data, and communications across several continents. But time was catching up with it.

Its computers and antennas still worked. Its solar panels still generated power. But it was running out of fuel.

Satellites like Intelsat-901 use a liquid chemical propellant called hydrazine for station-keeping: the tiny, constant orbital corrections that keep a satellite locked in place against the gravitational pulls of the Moon and Sun.

Without it, Intelsat-901 would lose its grip on its assigned orbital slot. Its signals would degrade. And it would no longer be viable.

For most of the history of spaceflight, that would have been the end of the story. The satellite would be retired, written off, and eventually nudged into an increasingly congested orbital junkyard.

This time, a robotic spacecraft, MEV-1 (Mission Extension Vehicle-1), approached Intelsat-901, matched its speed to within fractions of a mile per hour, aligned itself with millimeter precision, and docked.

The automated craft latched onto the satellite and became its new propulsion and altitude-control system – extending its operational life by years.

If you still think of space as a destination for chisel-chinned astronauts or wealthy tourists, this moment probably passed you by. But if you want to understand what the space economy is becoming – and how to profit – it was every bit as consequential as the first Moon landing.

Because space is no longer just a destination. It’s a new layer of infrastructure above our heads – one that keeps navigation apps accurate, ATMs and payment networks time-stamped correctly, aircraft tracked across oceans, military forces coordinated across continents, and emergency responders connected when storms knock out ground networks.

One day, it may also be where certain kinds of AI compute gets done – above the planet, powered by constant sunlight and cooled by the vacuum of space.

And thanks to a tipoff from one of our newest projects here at TradeSmith – a system that tracks the market’s most profitable investment themes – it’s also a top investing theme for 2026.

I’ll have more for you on this news “themes” tracker tool in future updates. Today, let’s look how you can get positioned for the next winners of the growing space economy.

Why Autonomous Space Robotics Are Replacing Human Operators

As we saw with Intelsat-901, once hardware is in orbit, humans become the bottleneck.

Putting people in space is slow, dangerous, and extraordinarily expensive. Every crewed mission adds life-support systems, redundancy, training, and risk – costs that quickly overwhelm the economics of modern space operations.

Space forces automation.

Modern satellites don’t just collect data and wait for instructions from Earth. They now:

- Monitor their own health

- Adjust power and thermal loads automatically

- Reroute around failures

- Coordinate with other satellites

- Decide which data is worth transmitting – and which isn’t

Space robotics isn’t about humanoid robots floating around with tools. It’s about autonomous systems that can inspect, refuel, assemble, reposition, and defend assets without waiting for human input.

The companies that master these autonomous systems – robotics, AI, and machine-driven decision-making – end up controlling a critical layer of the space economy.

Last week, I talked about why the space economy has moved from the realm of science fiction into the real world.

And I highlighted space-economy stock Rocket Lab (RKLB) – it launches small satellites into orbit and builds many of the spacecraft involved in these launches.

Today, let’s look at another opportunity worth putting on your radar.

Northrop Grumman: The Defense Giant Dominating Satellite Servicing Technology

Northrop Grumman (NOC) isn’t a pure-play “space stock” in the way Rocket Lab is.

It’s a diversified defense contractor with major businesses in aerospace systems, missile defense, stealth aircraft, cybersecurity, and national-security software.

But it’s also a leading designer and operator of mission-critical autonomous space systems – including MEV-1, which it developed through its subsidiary SpaceLogistics.

Northrop sits at the center of U.S. national-security space architecture.

It builds:

- Advanced satellites

- Space-based sensors

- Secure communications systems

- Integrated command-and-control platforms

These systems aren’t designed to phone home for instructions.

They’re built to detect, decide, and respond on their own – whether that’s tracking missile launches, monitoring military activity near borders and conflict zones, or maintaining communications when terrestrial networks are degraded or jammed.

Satellites can’t wait for humans to intervene. They have to manage power, reroute signals, prioritize data, and maintain mission integrity automatically.

That’s been Northrop Grumman’s business model for years.

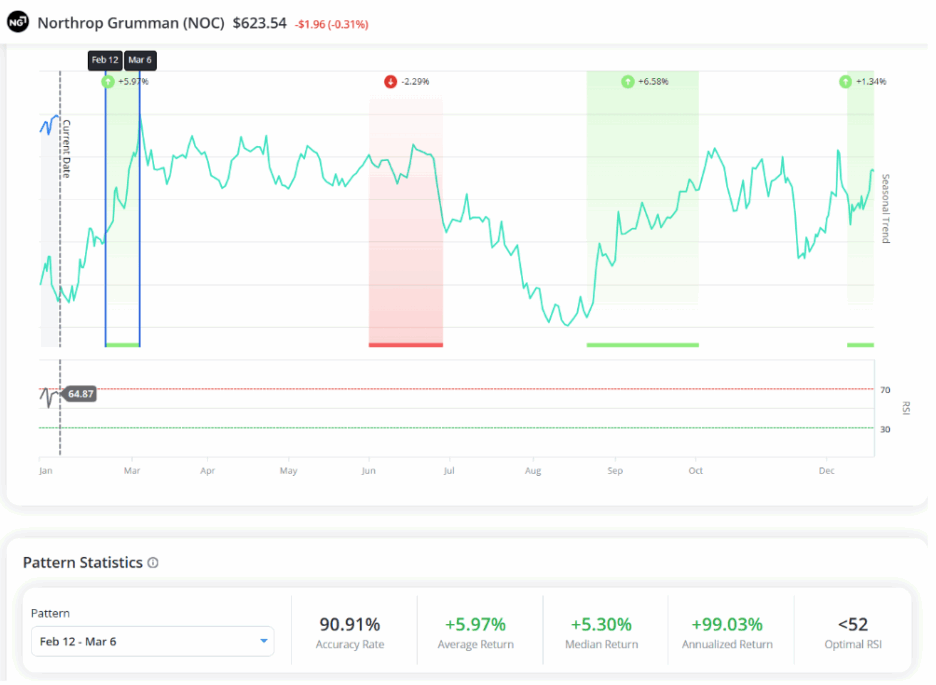

Buy Ahead of This Bullish Seasonal Window

All of this makes NOC a great long-term play on the space economy. But even long-term holdings benefit from better timing.

That’s where another of my favorite TradeSmith tools, Seasonality, comes in.

If you don’t know already, seasonality is the study of recurring calendar-based market patterns – specific times of year when stocks and sectors tend to move.

Most of these patterns are invisible to the naked eye. But our Seasonality software combs through decades of market data and more than 2 quintillion (that’s 2 million trillion) data points to find those patterns in what, to many, looks like random noise.

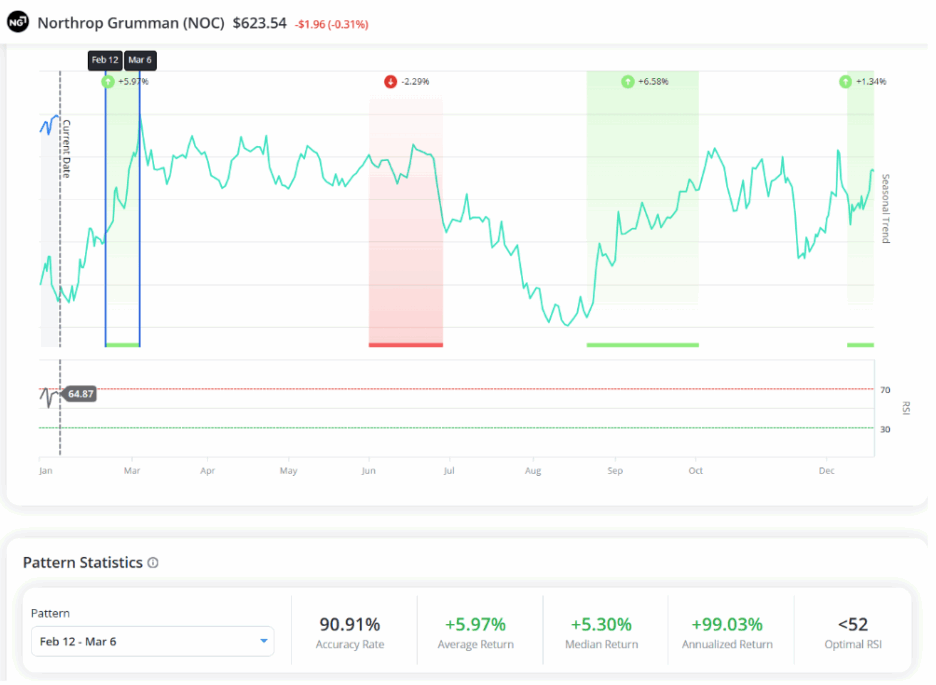

When we look at Northrop Grumman’s historical trading patterns, a clear window stands out next month. Take a look:

As you can see, the Feb. 12 to March 6 window (green shaded area to the left) has delivered gains more than 90% of the time. And the average return during that bullish seasonal window is just under 6%.

Why does this happen?

There’s no single cause. But defense stocks like Northrop often benefit from:

- Post-earnings digestion early in the year

- Budget visibility improving as government spending plans firm up

- Institutional rebalancing after January positioning

None of that guarantees a gain in any given year. Markets don’t work that way.

But patterns like this give disciplined investors an edge – a way to stack probabilities in their favor instead of relying on guesswork.

And that’s how you build serious wealth over time.

You can try out a trial version of our Seasonality tool right now by following this link to check these annual patterns on stocks you own or are thinking of buying.

We’ve made it available to all TradeSmith Daily readers alongside this year’s big seasonality event, Prediction 2026.

There are a bunch of important seasonal patterns coming up this month and beyond. And we want to make as many folks as possible are aware of what’s coming so they can prepare and profit.