Alphabet and ServiceNow Smash Earnings: Why the Best Is Yet to Come

After last night’s knockout earnings reports from tech titans Alphabet (GOOGL) and ServiceNow (NOW), we don’t think Silicon Valley’s message to Wall Street could be any clearer.

The AI Boom just continues to accelerate.

And if you’re still on the sidelines, it’s time to ask yourself a hard question: what exactly are you waiting for?

Let’s be real. Over the past 2.5 years, the stock market hasn’t exactly been balanced. It’s been wildly lopsided, reflecting a tale of two economies. One is crawling: old-school industrials, tired consumer brands, and limp small-caps stuck in a perpetual game of macro ping-pong. The other is sprinting – driven by the leaps and bounds we’ve seen from artificial intelligence.

We can use the Invesco QQQ Trust (QQQ) and iShares Russell 2000 ETF (IWM) as a gauge here. The former tracks the Nasdaq 100: heavily weighted toward mega-cap AI leaders. The latter reflects a broad swath of small-cap stocks, typically more exposed to U.S. macro conditions, higher interest rates, and legacy industries.

Just look at the difference in performance over the past few years…

The scoreboard doesn’t lie. Stocks follow earnings. And all the earnings growth is being sewn by AI-fueled tech giants like Alphabet and enterprise AI leaders like ServiceNow.

Big Tech is booming because that’s where all the earnings growth is happening.

Last night proved that this trend is not slowing down. It’s going vertical – and that’s great news for AI stock investors.

Gemini, Veo, Cloud: How AI Is Driving Alphabet’s New Growth Curve

We see Alphabet’s second-quarter earnings report as nothing short of a mic drop.

Its core ad business rebounded nicely, with Google Search revenue growth accelerating from 10% in Q1 to 12% in Q2. It’s the same story with YouTube – up 13% year-over-year. Yet, that’s not even what blew the roof off…

The real action was on the AI side.

Let’s start with Google Cloud, where revenue growth reaccelerated to 32%, up from Q1’s 28%. Operating income for the segment jumped to $2.8 billion from just under $1.2 billion in Q2 2024. That’s a 133% increase over the past year.

Gemini, the company’s flagship AI platform, now has over 450 million monthly users. Daily requests are up more than 50% since Q1. AI Overviews in Search reached over 2 million monthly users across 200-plus countries. And Veo3, Google’s AI video generator, has already generated 70 million videos – in just two months.

Where things get even crazier? Enterprise adoption. Google Cloud has signed more billion-dollar deals in the first half of 2025 than it did in all of 2024. Token usage in AI apps has doubled in only two months, and enterprise usage of Gemini has soared a massive 35X year-over-year.

All of this has driven Google Cloud’s backlog to an eye-popping $106 billion. And in response, Alphabet hiked its capex guidance by another $10 billion… Because it literally can’t build AI infrastructure fast enough to meet demand.

Clearly, the AI Boom at Alphabet is stronger than ever – and now the company is racing to spend even more money to keep up with the red-hot demand for all its new AI products and services.

ServiceNow: Enterprise AI Demand Is Catching Fire

If Alphabet’s results reflect the consumer side of the AI Boom, ServiceNow’s earnings are proof that enterprise demand is just as explosive.

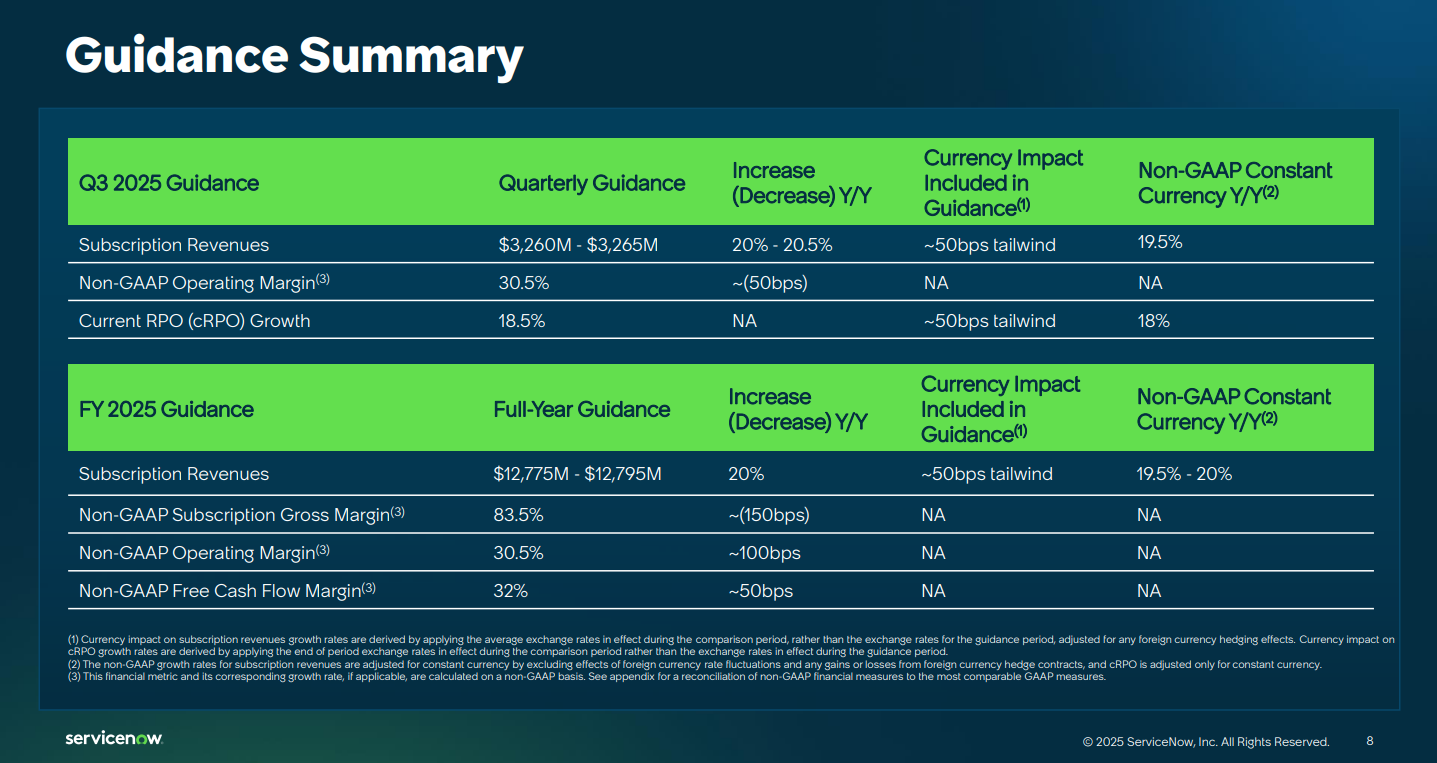

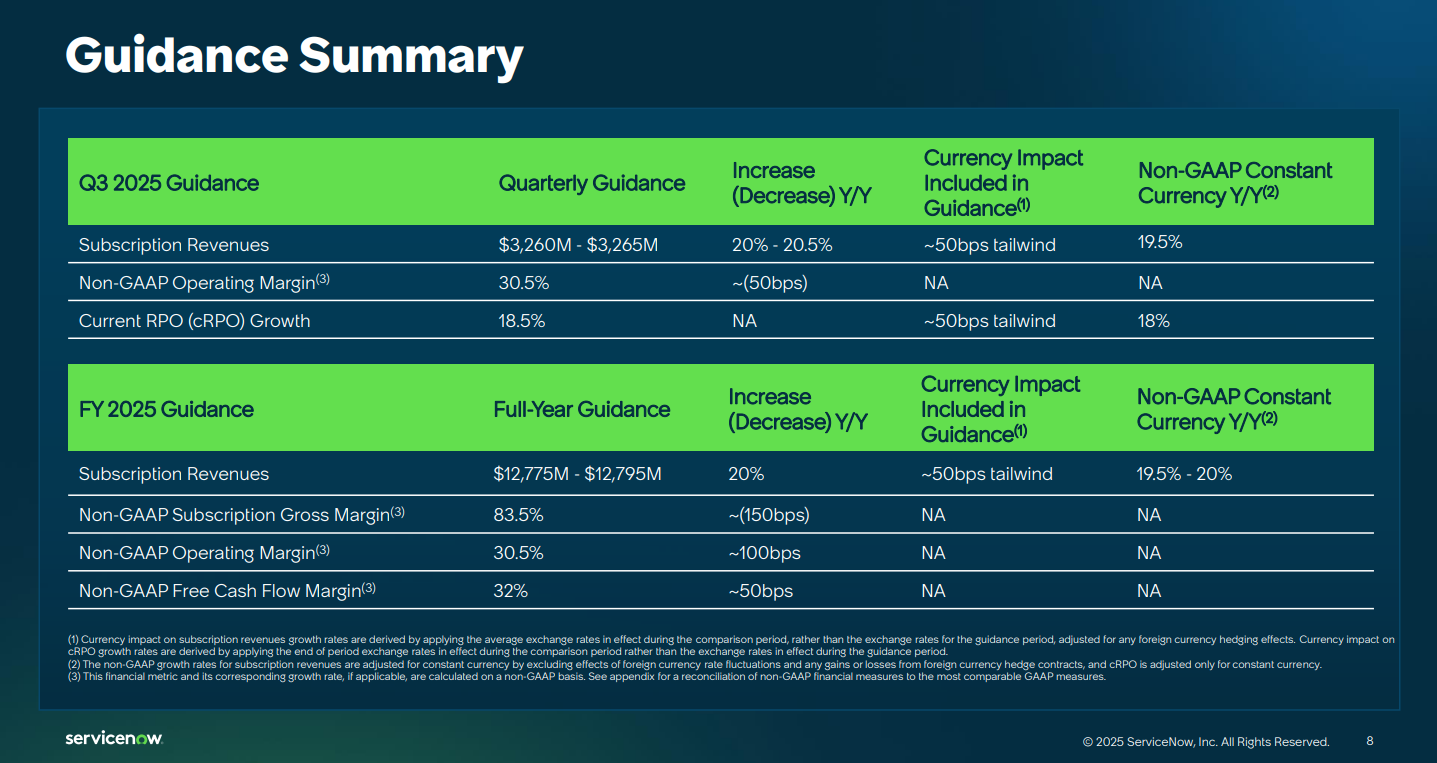

The company just posted another classic “beat-and-raise” quarter. Revenue is up more than 20%. Profits are up more than 30%; and management offered guidance for that kind of growth to continue for the next few quarters, too.

Driving this surge is – you guessed it – AI.

AI Pro Plus, ServiceNow’s AI license tier, saw deal count grow more than 50% quarter-over-quarter. Major customers like Exxon (XOM), Nvidia (NVDA), and Standard Chartered are all now rolling out ServiceNow AI agents across their global operations. And the firm just closed its largest-ever enterprise AI deal: a single $20 million contract for its Now Assist platform.

In short, these real AI workflows are quickly being embedded into trillion-dollar companies’ operations, with ServiceNow becoming the go-to for enterprise AI solutions.

Demand is stronger than ever right now. And there’s no signs that’ll change anytime soon.

Follow the Earnings: Why AI Stocks Are Still the Smart Money Bet

Let’s zoom out.

Over the past year, investors have repeatedly questioned whether the AI Boom is sustainable.

Is it just another tech bubble? Can this kind of growth really continue?

If you’re wondering the same, you’ll find that the answer is in the numbers.

Alphabet’s and ServiceNow’s explosive results prove that AI adoption is still in the very early innings. User growth is accelerating. Product demand is soaring. Revenue is climbing. Backlogs are ballooning. And the market is rewarding it.

Capital flows where earnings are strongest. And right now, all the growth is concentrated in AI and tech… Which means all the stock price growth will be, too.

Sure, some still believe this is just a temporary hype cycle. They cling to the idea that the market will “broaden out” and that leadership will eventually rotate.

Maybe someday it will. But right now, the earnings pie is being baked and eaten in Silicon Valley.

That’s where you want your capital to be.

Ignore the Noise; Buy the Trend

Now, we’ll be blunt. We think those investors who think the AI boom is a hype-fueled bubble waiting to burst are dead wrong.

What we’re seeing unfold isn’t a temporary rotation of capital. It’s a rewiring of the global economy to be built on tech.

So, where does this all lead?

Straight into what renowned futurist Eric Fry calls the Age of Chaos: a high-stakes period where powerful shifts in tech, geopolitics, and the economy could make – or break – fortunes.

Fry isn’t new to this game. He’s recommended more than 40 stocks that went on to soar 1,000%-plus, successfully navigating both bull and bear cycles.

Now, he’s back with what may be his most vital call of the decade.

Eric just released his “Sell This, Buy That” blueprint for navigating today’s AI-fueled mania. He’s naming seven tickers – four he says to ditch immediately… and three urgent buys he believes could be life-changing in the months and years ahead, including:

- A little-known robotics firm whose revenue has soared 15X since 2019 – and one that he believes could outmaneuver Tesla in the physical AI arms race

- An under-the-radar online retailer that Fry thinks could be the next Amazon… with 700% growth potential

- And a safer AI alternative to Nvidia: one he says could protect your capital and capture massive upside

He’s even giving away the names and tickers for free – plus all the research behind them.

Click here to access Eric Fry’s seven “Sell This, Buy That” trades for the Age of Chaos.

The AI Boom is real. Earnings are soaring. But not all tech stocks are built to survive this next phase.

Eric Fry says the next 12 to 24 months could be the most volatile of our lifetimes – and this may be your best shot to get positioned before a new economic order unfolds.