The AI Boom That Won’t Quit: Big Tech’s $500 Billion Spending Spree

Wall Street just got another taste of the AI future – and it’s having mixed feelings…

After reporting third-quarter earnings last week, Alphabet (GOOGL) and Amazon (AMZN) soared on surging AI demand, while Microsoft (MSFT) and Meta (META) slipped due to ballooning capital costs. It seems traders can’t decide whether to cheer the growth or fear the bill.

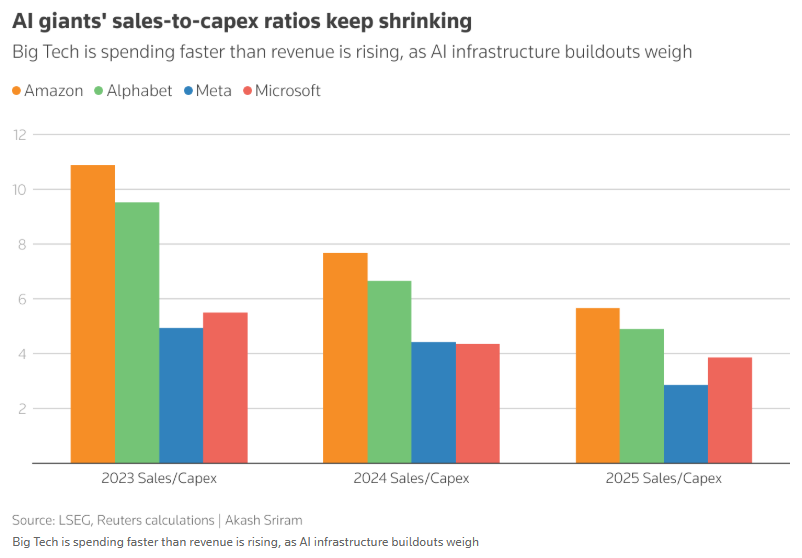

Indeed, as Big Tech’s capex spending outpaces sales, we’re seeing an ‘AI overbuild’ narrative taking hold.

But if you zoom out, the same “AI ROI” debate spooking investors is what’s fueling the next leg of the boom.

In the AI economy, capital spending is the top of the funnel. When the Big Four open the tap, every layer of the AI stack – from silicon to software – gets drenched.

Now that spigot is wide-open. And that torrent is far-reaching…

Why the AI Capex Flywheel Keeps Turning

When Big Tech spends $500 billion a year, that money cascades through the entire AI economy – from chipmakers like NVIDIA (NVDA) and AMD (AMD) to power and cooling suppliers like Vertiv (VRT) and Bloom Energy (BE)… and the countless software, automation, and robotics firms building on top of that infrastructure.

Every chip fab expansion, every cooling unit installed, every transformer upgraded all ties back to this capex supercycle.

That’s why we call it a supercycle, after all. It’s no temporary cash surge. It’s an ongoing restructuring of the world’s compute infrastructure, as big as the shift from mainframes to PCs, or from on-premises servers to the cloud.

Wall Street tends to panic about “AI fatigue.” That’s why, every time a company mentions ‘ROI uncertainty’ or ‘moderating growth,’ talking heads jump to the same conclusion: the boom is over.

But the numbers tell a different story.

Meta, Microsoft, Alphabet, Amazon – each is raising their spending.

If the companies with the best data, the most customers, and the deepest visibility into global AI demand are all deciding to ramp capex by 34% next year, that’s a flashing neon sign that the AI economy is accelerating.

Let’s do the math.

Capex Is the Fuel That Powers the AI Economy

Big Tech’s new spending plans make last year’s ‘AI splurge’ look small.

Based on the new commentary and updated capex plans from all four companies, here’s what our analysis suggests the spending picture looks like:

Estimated Capex

2025:

- Microsoft: $90 billion

- Meta: $71 billion

- Alphabet: $92 billion

- Amazon: $125 billion

Total: About $380 billion

2026:

- Microsoft: $140-plus billion

- Meta: $110-plus billion

- Alphabet: $110-plus billion

- Amazon: $150-plus billion

Total: $510-plus billion (34% year-over-year growth)

In other words, the Big Four are on track to spend more than half a trillion dollars on AI infrastructure next year.

To put that in perspective, that’s larger than the GDP of Sweden or the combined annual defense budgets of every NATO country (excluding the U.S.).

It’s an investment tsunami; and every AI chipmaker, data center operator, and software platform is riding the wave.

To see what this supercycle really looks like, follow the money – straight to the Big Four driving it.

Breaking Down the Numbers Behind the AI Capex Boom

Microsoft: Building the Grid for the AI Age

Let’s start with the biggest name in the game.

Microsoft’s earnings message was simple: demand for AI compute is outpacing supply, and the company is spending aggressively to close that gap.

This past quarter, its Azure AI infrastructure grew another 20%, with OpenAI demand alone consuming massive capacity. And it hinted that this supply-demand imbalance could persist. CFO Amy Hood said that the firm expects “to be capacity constrained through at least the end of our fiscal year.”

Translation: Microsoft isn’t even close to slowing AI spend.

Its $90 billion capex target for 2025 represents one of the most aggressive infrastructure buildouts in corporate history. And if CEO Satya Nadella’s tone on the call was any indication, 2026 will make that look small.

The company’s AI product adoption – from Copilot to Azure OpenAI – is accelerating, and every additional enterprise deployment means more GPUs, more networking, more power… more everything.

Microsoft isn’t just participating in the AI revolution. It’s building the grid that powers it.

Amazon: The Quiet Engine of the AI Cloud

Amazon is turning its AI infrastructure into a profit engine hidden in plain sight, quietly capturing the lion’s share of AI workloads – and doubling capacity to keep up.

AWS’ backlog exploded last quarter, growing to over $200 billion, and the company signed more AI cloud deals in October than in all of Q3 combined. Amazon has quietly doubled its total compute capacity since 2022, yet demand is still exceeding supply.

To keep up, it aims to keep building – data centers, chips (Trainium, Inferentia), and its new AI-as-a-Service offerings like Bedrock and AgentCore. Capex is expected to exceed $150 billion next year; and that’s before factoring in the company’s next wave of regional data centers in Asia and the Middle East.

Instead of just riding the AI wave, it looks more like Amazon is trying to own the ocean.

Alphabet Bets Big on AI Infrastructure Expansion

Alphabet’s story was equally telling.

After spending the better part of a decade optimizing its balance sheet, Google has shifted gears into a capital-intensive mode not seen since the birth of YouTube. CEO Sundar Pichai described AI as “the most profound platform shift in our lifetimes” and said that conviction is now showing up in the numbers.

After revising capex estimates upward for the third time this year, the company expects spending will stay elevated as it expands data center capacity to support Gemini, Vertex AI, and its cloud customers. Google’s tone was matter-of-fact: this is a long-term build, and the returns will compound over time. Just as with Microsoft, the implication is clear: spend now, monetize later.

Meta: All-In on the AI Arms Race

Then there’s Meta.

Mark Zuckerberg dropped any pretense of moderation. The company raised its full-year capex outlook again and signaled that 2025 and ’26 will bring even larger jumps as it builds out “AI-centric data centers” for its open-source Llama models, recommendation engines, and generative content systems.

This shift is staggering. Two years ago, Meta was spending about $30 billion annually. By 2026, it’ll be north of $110 billion – almost a 4x increase. That’s not “steady investment.” That’s an AI arms race.

And Zuckerberg isn’t just talking about productivity tools. He’s laying the hardware and compute foundation for an AI-first era – one that could incorporate the original metaverse vision on a broader scale. With Meta’s capex now overwhelmingly focused on AI infrastructure, the old ‘Reality Labs burn-rate’ narrative is evolving…

Which is why investors shouldn’t fear the spending spree. It’s the clearest signal yet that the AI boom is far from over.

AI Stocks Are Cooling, But the Supercycle Is Heating Up

Markets are jittery. AI stocks have cooled off.

But the fundamentals beneath the surface have never been stronger.

With their latest batch of earnings, the Big Four just confirmed that the next leg of the AI Capex Supercycle is about to begin. That means more orders for chipmakers, more demand for data center builders, more power deals, more cooling systems, more software running on top.

The entire AI ecosystem will see another surge of capital, profits, and stock price growth.

So, when you see the headlines about AI slowing down, remember to take the 400-foot view. The companies actually writing the checks – Microsoft, Alphabet, Meta, Amazon – are signaling the opposite.

Take advantage of today’s market weakness. Buy the dip. This supercycle is just getting started.

In fact, the next wave is already forming – and it’s not staying on a screen.

Across factories, warehouses, and hospitals, intelligent machines are stepping off the server racks and into the real world. These systems run on the same algorithms powering Big Tech’s profits – only now, they’re reshaping entire industries.

It’s the natural extension of the AI Capex Boom – and where we see the next 10x opportunity emerging…

Discover the top plays to stake an early claim in the AI-robotics surge.