What the Dot-Com Bust Teaches About Today’s AI Vendor Financing

Vendor financing fueled the dot-com crash. Today, it’s back in AI…

Innovation has always opened the door to unprecedented market gains.

The personal computer… the internet… mobile connectivity… the cloud.

Every era has crowned new winners – and richly rewarded investors who spotted them early.

Take Apple (AAPL). The now-titanic firm began as a scrappy computer maker before reinventing itself with the iPhone and iPad. After going public in 1980 at around $22, it became the first U.S. company to hit a $2 trillion market cap in 2020.

Microsoft (MSFT) rode a similar wave. From its $21 IPO, it dominated the PC and internet-software era. And today, it trades above $470 – a gain of more than 2,100%.

Alphabet (GOOGL) defined the cloud era, and now it’s being supercharged by AI. Its revenue has exploded from just $3.18 billion in 2004 to more than $350 billion in 2024.

But every boom has a bust – and fortunes can vanish as quickly as they appear.

Look at Cisco (CSCO). The company went public in 1990 and soared as it became the backbone of the early internet, peaking around $80 in March 2000. Then the dot-com bubble burst.

A bloated valuation, excess inventory, and deteriorating conditions hit hard. But what truly cemented the collapse was likely circular financing.

At the height of the boom, Cisco not only sold networking gear – it helped finance the internet service providers that were buying it, temporarily inflating demand. When those customers collapsed, Cisco was left holding bad loans and weak sales, making the stock’s bust unavoidable.

Today, similar financing fears have investors dumping AI names – especially Nvidia (NVDA) – as money moves in circles across the AI build-out.

But the real question isn’t whether the money loops. It’s whether that loop eventually lands on real, lasting end-market demand.

And that’s exactly what we’ll explore in today’s issue…

How AI Vendor Financing Works (and Why Investors Are Watching Closely)

At a high level, the AI stack today looks like this:

Nvidia + chipmakers → AI infrastructure players (hyperscalers, GPU clouds, lessors, data centers) → Model providers & AI apps → Enterprises & end users

Now layer the money that flows on top:

- Nvidia and other vendors do more than just sell chips; they invest in GPU clouds and infra startups, and offer great terms, long pay-later windows, or system-level deals.

- Infra players use vendor capital, debt (often collateralized by GPUs), and equity from VCs/strategics to buy more GPUs and build more data centers.

- Model providers & AI apps rent that capacity and resell it as AI APIs, chatbots, copilots, AI tools, etc.

- Enterprises & users pay subscriptions and usage fees. That’s the real cash that should propagate back up the stack and justify all of this.

So, when people talk about ‘circular money’ here, they’re pointing to the fact that Nvidia might invest in an AI infrastructure company… which then buys billions of dollars of Nvidia hardware… which lets Nvidia book huge revenue and earnings… which it can then recycle into more strategic investments.

It does sound sketchy. But here’s the key: Circular financing is only toxic if the circle never closes with real, external cash flow.

If the loop ends at a profitable customer – a retailer, bank, advertiser, etc. – who happily pays for AI-powered services because they work… then vendor financing is just an accelerant.

If the loop ends at hype and a balance sheet that never self-funds, then vendor financing is deadly…

Which is why so many folks are citing the fallout from the dot-com bust.

The Dot-Com Vendor Financing Cycle and the Lessons for AI Builders

Cisco wasn’t the only dot-com darling to go belly-up from circular financing.

Back then, the stack looked like this:

Equipment vendors Cisco/Nortel/Lucent → Telecommunications firms & long-haul carriers (WorldCom, Global Crossing, etc.) → Dot-coms & enterprises → End users

Those telcos borrowed insane amounts of money to build long-haul fiber networks and internet infrastructure, financed via vendor loans, leasing arrangements… Some equipment vendors even took equity stakes in carriers who then bought more of their gear.

On paper, it all made sense. Internet traffic was exploding. Everyone expected we were moving into an all-IP, bandwidth-everywhere future. The mantra was basically: ‘If we build it, demand will show up – with thick margins.’

And for a while, they were right. Demand really was booming, just like it is with AI today.

But that didn’t last…

Overbuilding, Overspending, and the ‘Dark GPU’ Parallel

The problem wasn’t that there was no demand. It was that companies built way more infrastructure than profitable demand could fill.

Telcos laid tens of millions of miles of fiber, much of which stayed ‘dark’ (unused). Supply vastly outpaced profitable demand. Bandwidth prices collapsed, and capacity became a commodity.

When financing conditions tightened, Telcos slashed capex. Many went bankrupt (WorldCom, Global Crossing, 360networks, etc.). Equipment vendors had to take massive write-downs on vendor loans and unsold inventory. And the whole vendor-financing flywheel seized.

The internet itself didn’t die. The financing structure did. And the ‘dark fiber’ became the symbol of what killed the cycle: too much infrastructure, not enough profitable end-market demand, and too much leverage in between.

That’s exactly what today’s AI bears are warning about – but now with ‘dark GPUs’ instead of dark fiber.

Why Today’s AI Financing Looks Stronger – For Now

So… Are we just replaying 1999 with GPUs instead of routers?

Well, the structure rhymes; but so far, the substance is very different.

In the ’90s:

- The real end customers were fragile – dot-coms with no profits and enterprises just dabbling with the web.

- Telcos were insanely levered and structurally weak.

Today:

- The main buyers of AI infrastructure are Microsoft, Google, Amazon (AMZN), Meta (META), Apple, Tesla (TSLA), etc.

- These companies sit on hundreds of billions in cash, with enormous amounts of free cash flow, and have deep, diversified businesses (search, social, retail, productivity, cloud).

They’re not building infra just to resell bandwidth. They’re wiring AI into ads, recommendations, search, productivity suites, dev tools, enterprise software, e-commerce, and more.

In other words, there is real, substantial end-market demand for AI software and services and products.

Vendor Financing Isn’t the Core AI Engine

Across recent earnings… Microsoft, Google, Amazon, and Meta are all telling us some version of: ‘AI demand is outpacing supply; we’re capacity constrained; we’re raising capex again.’

Meanwhile, Nvidia is still effectively supply constrained on its highest-end accelerators. And hyperscaler capex for AI and data centers is hitting all-time highs – while management teams are framing it as catch-up, not “we built too much.”

Could that change in a few years? Absolutely. Yet, as of today, the problem is scarcity, not surplus.

And then there’s the money…

In the dot-com era, the economic thesis rested heavily on eyeballs, page views, and ‘new economy’ metrics. The boom wasn’t measured in dollars.

But that’s not true for AI, which is already:

- Boosting ad efficiency

- Increasing engagement in feeds and products

- Helping enterprises automate support, sales, coding, analytics

- Driving new revenue streams in cloud (via AI APIs, copilots, AI add-ons)

AI vendor financing is a risk amplifier, not the core engine. The core engine is still end-market demand for better ads, better software, better automation.

And so far, that demand looks very real.

We’re still early, and ROI will vary widely. But in our view, this is much closer to the cloud buildout than the dot-com bubble.

When the AI Financing Loop Could Crack: The ‘Dark GPU’ Risk Ahead

Now, just because the system is healthy today doesn’t mean it can’t break tomorrow.

The ‘dark GPU’ risk is very real – it’s just not a 2025 story.

Here’s what would need to happen for the AI vendor-financing cycle to crack:

- Hyperscalers massively overshoot on capex, building far more AI capacity than profitable workloads can fill between now and 2030.

- Enterprise and consumer AI demand disappoints.

- AI copilots don’t become must-haves.

- AI features become table stakes but not high-margin.

- Many AI apps fail to monetize beyond a niche.

- AI pricing comes under heavy pressure.

- Inference/token prices fall faster than infrastructure costs.

- AI APIs get commoditized by open-source competition and cheap alternatives.

- The leveraged middle layer cracks.

- GPU leasing firms and AI infra startups struggle to refinance.

- We see restructurings, bankruptcies, or forced asset sales.

- Capex is cut.

- Hyperscalers say ‘we’re digesting our buildout’ and flatten or lower AI capex.

- Chip vendors see order cancellations, inventory build, and lower utilization.

That would amount to the AI version of the dot-com bust – if the amount of infrastructure built isn’t justified by the cash flows it generates at the edge.

We are absolutely not there today.

Though, as an investor, it’s essential to follow these risks to protect our investments.

An Investor’s Dashboard for Tracking AI Financing Health

Here’s the framework I’d use going forward.

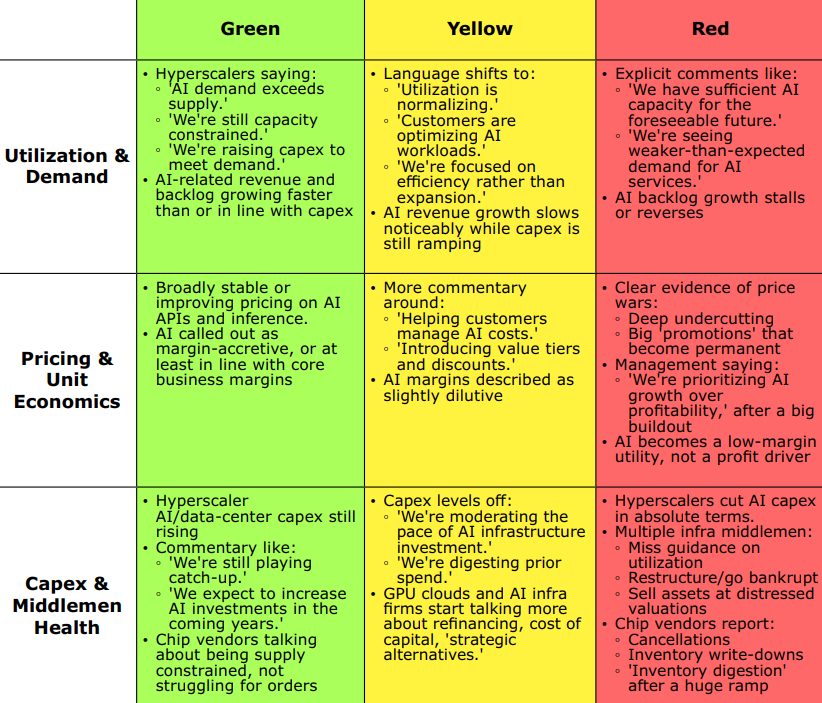

Think in terms of Green/Yellow/Red flags within three dimensions:

- Utilization & Demand

- Pricing & Unit Economics

- Capex & Middlemen Health

If that crimson combo shows up – capex cuts, weak demand commentary, pricing pressure, and infra distress – that’ll be our ‘AI dark fiber’ moment.

Now, where are we, right now, on that dashboard?

- Utilization / Demand: Green

Hyperscalers are still complaining about not having enough capacity. - Pricing / Unit Economics: Neutral-to-Green

Some cost sensitivity emerging, but no broad race to the bottom. - Capex / Middlemen Health:

- Hyperscaler capex: Bright Green – spending is still ramping.

- Leveraged middle layer: Yellow – business is booming; but balance sheets are stretched, and investor scrutiny is rising.

That’s not a bubble popping. That’s a boom maturing.

Could things change for the worse? Absolutely. That’s why we can’t just buy the narrative; we have to watch the signals.

But, so long as GPUs are scarce rather than dark, enterprises keep finding profitable AI use cases, and the middle layer of the AI stack stays functional…

Every fear-based headline is less of a warning…

…and more of a buying opportunity for the investors who know how to read the gauges.

The Bottom Line: Circular Doesn’t Mean Fragile Yet

As you can probably tell, this isn’t the same market we were operating in years ago. The center of gravity in American innovation has shifted.

For example, Washington is no longer a background actor – it’s a capital allocator, a gatekeeper, and, in many cases, the decisive force behind which companies scale and which companies stall.

And that’s exactly why our research team now treats government signals the same way we treat earnings revisions, product launches, or technological breakthroughs. In a world where the White House is openly shaping strategic industries – from rare earths to chips to AI infrastructure – the ability to read those signals becomes a real edge.

Because once you understand the pattern… know how Washington picks its national champions… and can read the ‘gauges’ on both policy and market demand…

You stop guessing, and you start anticipating.

And that’s where the real opportunities emerge.

In fact, I recorded one more video for you that details one such opportunity we found this way. It’s part of the new playbook for making outsized returns – be sure to watch it before tomorrow morning, when I’ll reveal what I’ve been working toward for the past several months.

To give you a hint, we’re building our shortlist of the next potential national champions – companies that check all three boxes, sit squarely in America’s strategic interest, and stand to benefit as this AI boom matures rather than fades.

I’m excited about what we’re uncovering. And as always, I’ll keep you updated every step of the way.

Talk soon – and get ready for more.