Washington’s New Plan for the Housing Market

The American housing market is broken in a way that no interest rate cut can fix.

Buyers can’t afford the monthly payments. Sellers won’t give up their 3% mortgages. Inventory is frozen. Prices stay irrational.

But while economists debate Fed policy, the White House is preparing a different playbook entirely – one that separates the home price from the payment and turns the mortgage itself into a tradable asset.

Since November, we’ve seen reports that the Trump administration is considering an “aggressive” intervention in the U.S. housing market. The president has been meeting with top housing officials, including FHFA Director William Pulte, to discuss structural financial reengineering, circulating notable buzzwords like “Assumable,” “Portable,” and “50-Year.”

If you think this is just more political noise, you’re missing the single biggest asymmetry in the market right now.

Here’s why we think housing could become one of 2026’s biggest under-the-radar trades.

Why the Housing Market Has Become a Political Emergency

To understand the potential here, you have to understand the desperation.

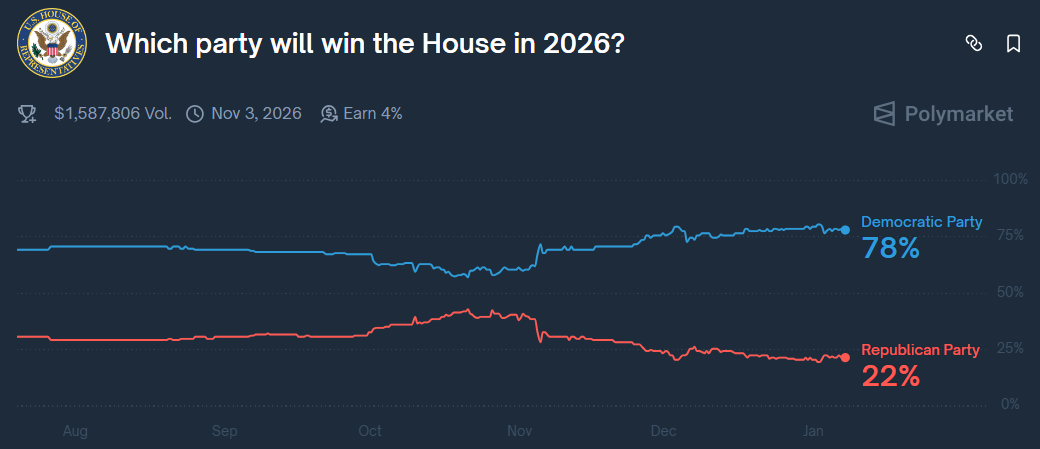

We are now 11 months away from U.S. midterm elections. And if you look at the betting markets, like Kalshi and Polymarket, the writing is on the wall. The GOP is facing a potential wipeout in the House, as well as a close fight for the Senate.

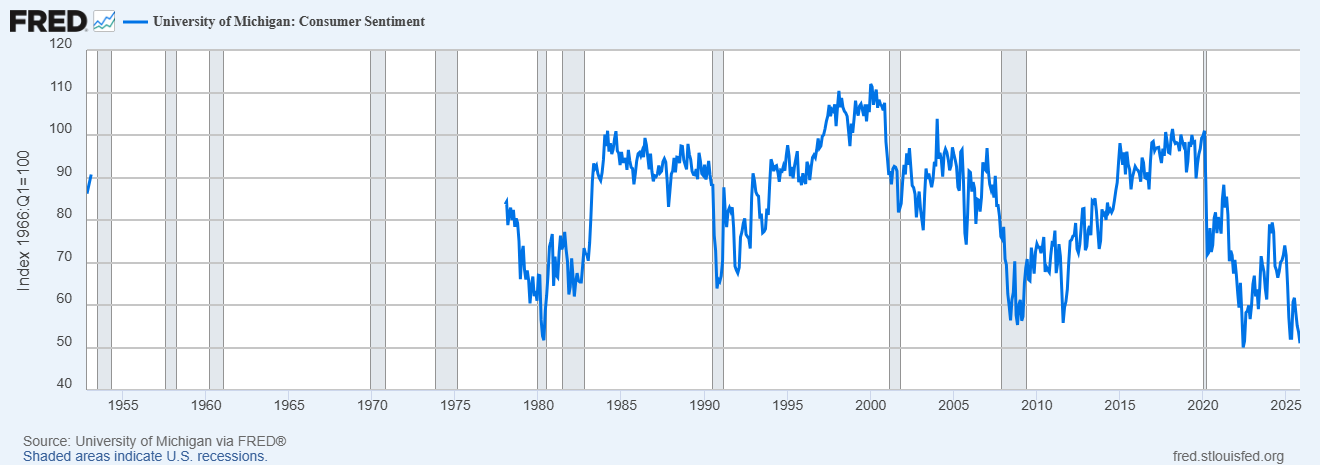

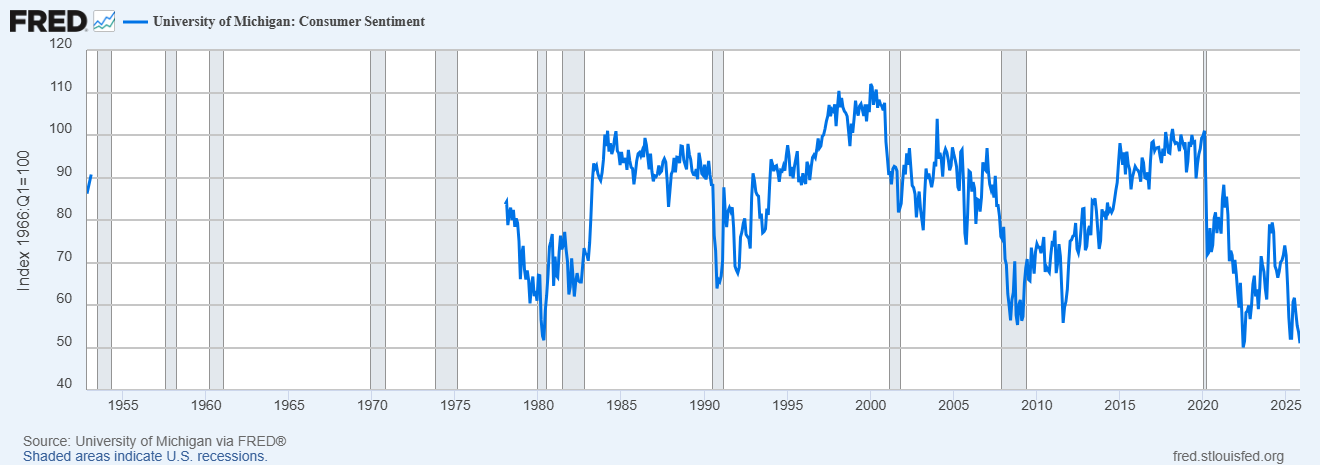

Why? U.S. consumer sentiment is languishing at historical lows, driven almost entirely by the affordability crisis.

The “American Dream” of buying a house is mathematically impossible for the median voter, locking out an entire generation from the market. Meanwhile, an older generation of voters are locked in, clinging to 3% mortgage rates from the pre-COVID era, refusing to sell and take on a 7% loan.

This ‘lock-in’ effect has frozen inventory, keeping prices elevated. High prices + high rates = angry voters.

President Trump knows he cannot wave a wand and make the Federal Reserve drop rates to zero tomorrow without reigniting inflation.

So, he has to do the next best thing: separate the home price from the monthly payment.

The Mortgage Reforms Washington Is Considering

The meetings at Mar-a-Lago represent an important shift. Instead of waiting for the Fed, the Trump administration is preparing to flood the zone with liquidity mechanisms that bypass the banks’ traditional underwriting models.

Here is what is on the table and why it matters:

The 50-Year Mortgage: Lower Payments, No Equity

Federal officials are discussing extending loan terms from 30 years to 50 years.

- The Logic: It immediately slashes the monthly payment.

- The Reality: It turns homeownership into a glorified rental. You build zero equity for the first 15 years; you are just servicing debt.

- Why it happens: It’s the easiest lever to pull. The FHFA can simply direct Fannie and Freddie to buy these products. It creates an immediate talking point: “Under my plan, your monthly payment drops by 20%.”

Assumable Mortgages: Turning Low Rates Into Assets

This is the policy that allows a buyer to take over the seller’s existing mortgage rate.

- The Logic: If I have a 3% mortgage, it’s an asset. Why should it die when I sell the house? I should be able to hand it to you.

- The Reality: Banks hate this. When a 3% loan is paid off, the bank celebrates because they can lend that money out again at 7%. If the loan is assumed, the bank remains stuck with a low-yield asset.

- Why it happens: It is populist gold. Trump vs. Wall Street.

Portable Mortgages: The Only Fix for Frozen Inventory

This allows a homeowner to sell their house, move to a new one, and take their 3% interest rate with them.

- The Logic: This unlocks the supply side. The Boomer who wants to downsize but won’t give up their rate can finally sell.

- The Reality: This is a logistical nightmare for the bond market (MBS), but it is the only thing that actually solves the inventory crisis.

Why Housing Reform Is a 2026 Election Trade

Why is this a 2026 trade? Because in politics, timing is everything.

The administration cannot afford a slow rollout. It needs a “sugar high,” so to speak – where voters see “Sold” signs and lower Zillow estimates before they walk into the voting booth in November.

As such, we can likely expect the following timeline:

- Q1: The leaks continue. Test balloons are floated to gauge the bond market’s reaction.

- Q2: Executive orders – Trump likely declares a “Housing Emergency” or utilizes the FHFA’s conservatorship over Fannie/Freddie to unilaterally launch the 50-year product.

- Q3: The push for portability – this will be the “October Surprise”: a program designed to unfreeze millions of homes right as campaign season peaks.

Who Benefits If the Housing Market Is Unfrozen

If the government decides to artificially lubricate the housing market, you do not want to be short housing. You want to be long the companies that facilitate the transaction.

Homebuilders: Direct Beneficiaries of Demand Stimulus

Stocks like Lennar (LEN) and D.R. Horton (DHI) are the obvious trades. If the government subsidizes monthly payments via 50-year terms, homebuilders can raise prices. They are the direct beneficiaries of any demand-side stimulus.

Mortgage Insurers: The Hidden Toll Collectors

Fifty-year loans are risky. Someone has to insure them. Private mortgage insurers – like MGIC Investment Corporation (MTG) and NMI Holdings (NMIH) – will see a boom in premiums as the government mandates coverage for these new, longer-duration loans.

Digital Settlement Platforms: The High-Beta Infrastructure Play

Here’s where we get specific. If you want the high-beta, potential 10x play on this thesis, you need to look beyond the obvious homebuilder trade.

The real asymmetry lies in the infrastructure layer: the companies that can facilitate what traditional finance cannot.

The administration’s biggest goals – portability and assumability – are nightmare problems for conventional lenders and title companies.

A local title officer cannot handle the complexity of transferring a mortgage collateralized by a bond from one property to another in real-time.

A traditional bank doesn’t want to facilitate an assumable loan because they lose money on it.

To make this work, the administration needs a centralized, digital clearinghouse – a platform that can:

- Identify the value of the locked-in rate

- Match the seller (with the rate) to the buyer (with the cash)

- Crucially: Step in the middle to “bridge” the transaction

The Infrastructure Layer the Housing Market Needs

Think of this as the Market Maker Function for mortgages. To make a mortgage portable, there’s often a timing gap. You sell your house on Monday, but don’t sign for the new one until Friday. The bank won’t let the loan “float” in the ether.

But a digital platform with sufficient balance sheet capacity can solve this. It buys House A (taking the asset onto its balance sheet), holds the mortgage structure temporarily, and facilitates the transfer to House B.

The Technical Requirements: Any platform positioned for this opportunity needs three things:

- The balance sheet to temporarily hold real estate assets

- The technology stack to automate assumable mortgage transfers

- The political connectivity to become an “authorized digital settlement platform”

The Silicon Valley Angle: Look at who’s sitting at the table in Mar-a-Lago. The “Silicon Valley Right” views the housing crisis not as a lack of regulation, but as a lack of technology. They’re likely arguing: “Mr. President, the banks are too slow. Give the mandate to the tech companies. Let us build the digital exchange for American Homeownership.“

There’s a small handful of venture-backed prop-tech companies that fit this profile – companies currently trading like distressed assets that could re-rate overnight from “risky tech plays” to “critical financial infrastructure” the moment an Executive Order drops.

But there’s only one with the potential to become ‘the next Amazon’…