The Greenland Gambit: Trading the World’s Most Dangerous Real Estate Deal

Trade the chaos: 11 stocks positioned to profit from Trump’s Greenland resource grab

If you’ve been watching your portfolio bleed this week amid President Trump’s ultimatum to Denmark over Greenland, your natural instinct is likely to cash out.

Screens are red, and the bond market is revolting – because the narrative is terrifying: a fracturing NATO alliance, threats of crippling tariffs on Europe by February 1, and a violently spiking 30-Year Treasury yield threatening to wreck the housing market.

It looks like a chaotic geopolitical trainwreck.

But if you take a step back from the noise, you’ll realize this is a rerun. We have, in fact, seen this rodeo before.

It’s this administration’s defining strategy. And it’s about to create a massive buying opportunity.

What is happening right now is not a random outburst; it is a brutally effective, high-stakes negotiation designed to secure the single most important supply chain of the next 20 years.

This ‘Greenland gambit’ is all about the physical inputs required to power the Artificial Intelligence revolution.

And for investors who understand the playbook – the precedents that predict how it ends and the specific stocks to own when the deal is inevitably struck – the resulting relief rally will offer the clearest alpha opportunities of the year.

Why the U.S. Wants Greenland’s Rare Earths and Uranium

To understand this trade, strip away the diplomatic theater and look at the geology.

Here’s the problem: China controls roughly 90% of the processing for rare earth elements – the essential ingredients for the permanent magnets that go into every EV motor, wind turbine, and advanced robotics that will define the next phase of the AI boom.

Meanwhile, the AI data center buildout is hitting a hard ‘energy wall.’ And the only scalable, carbon-free solution to powering gigawatt-scale compute clusters is nuclear energy.

Controlling Greenland is a singular move to break China’s chokehold on critical minerals and secure the fuel for the Western AI infrastructure buildout. Deep under its melting ice sheet lies the Kvanefjeld deposit – arguably the world’s largest undeveloped resource of both rare earth elements and uranium.

With this ‘Greenland Gambit,’ Trump is trying to buy energy independence for the 21st century.

Trump’s Greenland Negotiation Follows the Liberation Day Playbook

Why the chaos? Because that is the tactic.

There’s a strong pattern in the Trump negotiation style: create overwhelming, existential leverage to force a binary outcome.

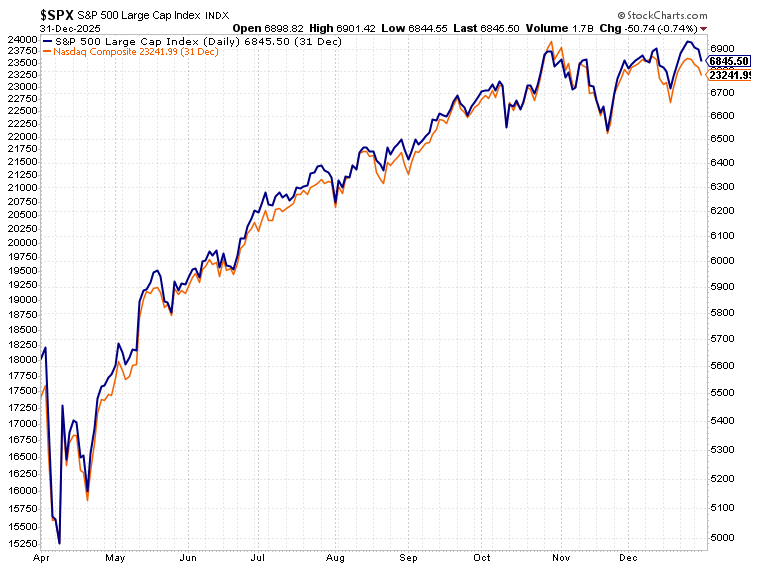

We saw exactly this during the “Liberation Day” tariff scare in April 2025. The threat of universal baseline tariffs promised to crush global trade. The markets tanked. Pundits predicted a global recession. Then, at the 11th hour, deals were cut. The tariffs were swapped for “managed trade agreements.” And the market surged in a massive relief rally, with the S&P 500 rising about 30% and the Nasdaq gaining 45% between April 21 and November 1.

The Greenland scenario is the “Liberation Day” playbook applied to a sovereign asset. The threats of auto tariffs on Germany and wine tariffs on France are the leverage designed to force the EU to pressure Denmark to the table.

The main difference this time – and the reason the bond market is so jittery – is that unlike a trade quota, you can’t split Greenland down the middle. It’s a binary asset. This creates a much narrower landing zone for a deal, increasing the apparent risk.

But the mechanism remains the same: maximum pressure yields maximum concession.

Midterm Politics and Davos Timing to Force a U.S.-Greenland Deal

Right now, as markets convulse, the world’s financial and political elite are currently sipping champagne in Davos. There is no better backdrop for the kind of backroom, face-saving diplomacy required to resolve this.

But the biggest reason a deal will get done isn’t in Switzerland; it’s in the American suburbs. We are in a midterm election year.

The administration’s core domestic mandate is affordability – curing inflation and keeping the cost of living under control. And the current spike in Treasury yields is a direct threat to that mandate. If the 10- and 30-year yields continue to tear higher because foreign buyers are striking against U.S. debt, mortgage rates will skyrocket, crushing the housing market just as voters head to the polls.

Plus, actually implementing tariffs on all European goods would spike inflation instantly.

The administration cannot afford a self-inflicted slowdown or recession in a midterm year. This creates a “Midterm Collar” on the downside. The political reality forces them toward a resolution. They need a “win” they can sell to the base, not an economic crisis.

The Most Likely Greenland Outcome

Given the midterm pressure, the likelihood of a full-blown conflict where tariffs hit and NATO fractures is low; perhaps a 10- to 20% tail risk.

We think the overwhelming probability (80- to 90%) is that the “Liberation Day” pattern repeats. Denmark will not sell its citizens. But Trump will get what he actually needs: effective control over the resources.

Expect a “Joint Arctic Security & Resource Framework.” It will be framed as a massive diplomatic victory. The U.S. will gain exclusive military basing rights and, crucially, fast-track leases for American companies to develop the Kvanefjeld deposit, likely with royalties shared with Denmark and Greenland.

Europe gets security guarantees. Trump gets the minerals. The market gets relief.

How to Trade the Greenland Deal: Buying the Relief Rally

When a deal is announced, the relief rally will be ferocious. The fear premium evaporates. Money floods back in.

But don’t just buy the broad market. Buy the sectors that are directly unlocked by this deal.

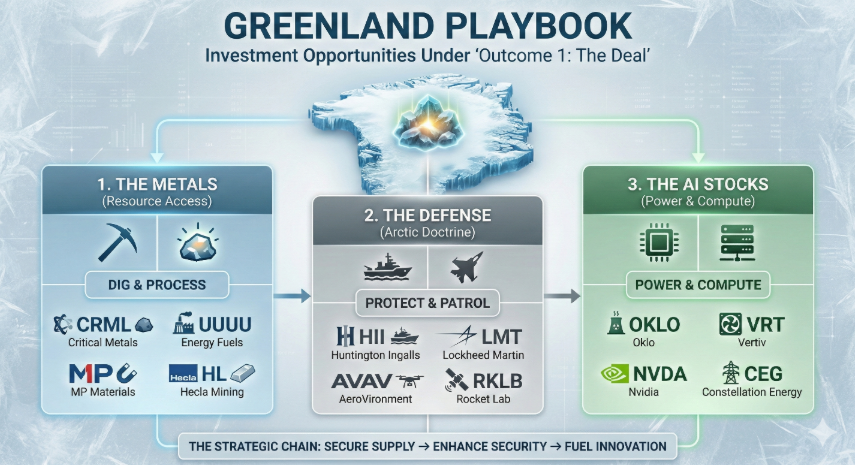

Our “Greenland Playbook” involves three distinct baskets that ride the wave of resource access, re-militarization, and AI infrastructure.

Basket One: Four Rare Earth Stocks to Buy Now

These are the highest-conviction plays. If the U.S. secures access to Greenland’s deposits, these companies could go from speculative miners to critical national security assets.

- The Processor: Energy Fuels (UUUU). This is arguably the most strategic play in the entire thesis. You can mine the rocks in Greenland, but you need somewhere to process them. Energy Fuels owns the White Mesa Mill in Utah: the only existing facility in the U.S. capable of processing the monazite sands that hold rare earths and uranium. When the Greenland deal closes, UUUU becomes the indispensable domestic hub for the entire supply chain.

- The Domestic Champion: MP Materials (MP). MP is already the premier Western rare earth producer, heavily backed by the Department of Defense. A deal in Greenland confirms that the U.S. is going “all in” on a non-China supply chain. MP will likely see increased government funding – and a complete repricing of its strategic value as the cornerstone of Western magnet production.

- The Direct Asset: Critical Metals Corp (CRML). For those seeking higher beta, CRML holds the Tanbreez project in Greenland. It is a massive, simpler rare earth deposit than Kvanefjeld. If the political doors open, this company’s asset suddenly becomes viable, making it a direct beneficiary of American capital flowing north.

- The Silver Lining: Hecla Mining (HL). Don’t overlook silver. It sits at the intersection of two major themes: it’s a monetary hedge against chaos, but it’s also a critical industrial metal for electronics and defense hardware. As North America’s largest producer, Hecla is the safest way to play the increased industrial demand.

Basket Two: Three Arctic Defense Plays on U.S. Military Expansion

Deal or no deal, the geopolitical temperature has permanently changed. The Arctic is now indisputably the next major theater of military competition with Russia and China. The “Greenland Threat” has solidified the need for a massive re-stocking of polar-capable hardware.

- The Shipbuilder: Huntington Ingalls Industries (HII). The U.S. has an “Icebreaker Gap.” Russia has dozens; the U.S. has barely two operational heavy icebreakers. You cannot project power in the Arctic without them. HII is the prime naval shipbuilder and will be the primary beneficiary of the inevitable congressional mandate to build a polar fleet.

- The Standard Bearer: Lockheed Martin (LMT). The F-35 is the fighter jet of the Arctic, flown by Norway, Denmark, and Finland. A deal that enhances U.S.-Nordic military integration further solidifies LMT’s dominance in the region.

- Eyes in the Sky: Rocket Lab (RKLB). Patrolling the vast, inhospitable Arctic with ships is difficult. The U.S. Space Force will increasingly rely on polar-orbiting satellite constellations for surveillance and communications. And Rocket Lab is a prime player in launching and managing these dedicated national security payloads.

Basket Three: AI Infrastructure Stocks Unlocked by Greenland Uranium

This is the “coiled spring” trade – where the real money gets made.

High-growth tech has been compressed by the spike in interest rates. When the Greenland deal is signed and yields stabilize, tech will lead the relief rally.

But more importantly, the deal will signal a resolution to AI’s biggest bottleneck: energy.

- The Nuclear Option: Oklo Inc. (OKLO). Sam Altman backed Oklo for a reason. AI data centers need 24/7, carbon-free power that doesn’t rely on the volatile grid. Small Modular Reactors (SMRs) are the solution. A deal that secures Greenland’s uranium supply is a massive green light for the nuclear renaissance required to power AI.

- The Utility Giant: Constellation Energy (CEG). As the largest owner of nuclear power plants in the U.S., CEG is the immediate answer for hyperscalers looking for baseload power right now. Securing long-term uranium supplies de-risks their entire business model.

- The Infrastructure Play: Vertiv Holdings (VRT). If the energy bottleneck clears and the data center buildout re-accelerates, cooling becomes critical. VRT is the leader in cooling these massive AI clusters. It is a high-beta play on the resumption of the infrastructure boom.

- The Titan: Nvidia (NVDA). When the macro fear subsides, the market returns to fundamentals. Nvidia remains the undisputed king of compute; and a stabilized rate environment allows its multiple to expand again.

The Greenland Investment Window Is Closing Fast

The headlines right now are designed to terrify you.

But if you believe, as the midterm political math suggests you should, that this is a high-stakes negotiation rather than the start of World War III, this is the buying opportunity.

The administration is using maximum leverage to solve a twenty-year strategic deficit in critical minerals. After a deal is struck in Davos, the window to buy the companies that form the backbone of this new supply chain at discounted prices will close.

The chaos is the opportunity – and those prepared will profit.

Buy into the industrial supercycle this administration is throwing gasoline on.