The Lost Decade Is a Warning Most Investors Have Forgotten

Editor’s Note: Not every crash looks like a crash. Sometimes it’s just ‘dead money’ – months or even years where the market drifts and leadership quietly changes hands.

That’s the risk my colleague Louis Navellier is flagging today. He’s drawing lessons from the Lost Decade – a time when most investors stood still while a small group tacitly built generational wealth.

He believes we could be entering another one of those transitional moments. And if he’s right, the path to wealth won’t start with the same names everyone’s been holding since 2020.After you read Louis’ piece, don’t miss his free Hidden Crash 2026 briefing, where he explains the signals he’s tracking, the risks he sees forming, and how investors can position themselves as leadership shifts once again.

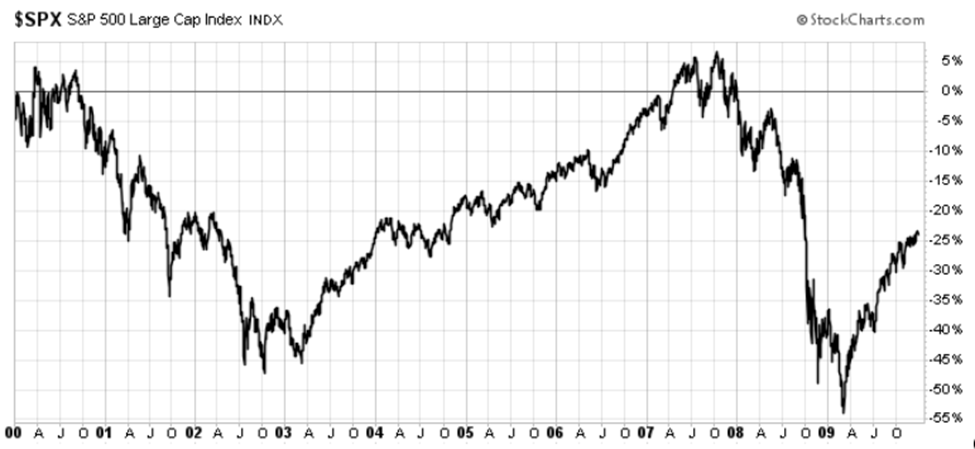

The chart below illustrates one of the most dangerous periods in modern market history.

From 2000 to 2009, the S&P 500 essentially went nowhere.

On Wall Street, it became known as “The Lost Decade.”

I remember it because I lived through it. Many of you did, too.

But here’s the funny thing. Because of the way our brains are wired, we tend to forget periods like this.

Those who forget history are likely to repeat it, and a similar danger is appearing on the horizon. So, let’s remember…

After the dot-com bubble burst, there was a prolonged period of market malaise where essentially nothing happened.

During the previous dot-com boom, companies like Microsoft Corp. (MSFT), Cisco Systems Inc. (CSCO), and Intel Corp. (INTC) became household names.

But during The Lost Decade, these stocks lost investors’ hard-earned money.

Cisco never regained its prior highs. Intel stagnated for years. Even Microsoft spent much of that decade treading water.

Meanwhile, things were happening under the surface – you just had to know where to look…

- An upstart beverage company, now known as Monster Beverage Corp. (MNST), dominated the energy drink market and delivered gains well over 1,000%.

- Rapid growth in China led to surging demand for copper, and mining company Freeport-McMoRan Inc. (FCX) soared 1,400% at its peak.

- A little-known company named Google Inc. (GOOG) debuted on the market in 2004. We all know what happened after that…

These weren’t lucky exceptions. Market leadership had quietly shifted.

I call periods like this Hidden Crashes – and they are far more dangerous than sudden selloffs.

During these stretches, investors who stay tethered to what worked before often find themselves stuck in dead money. (Dead money is when capital stays invested but fails to compound meaningfully, the most expensive mistake investors make.)

But investors who recognize where earnings momentum is accelerating are able to move on and make money.

Here’s the thing about crashes. Most investors remember the violent jolt that happens when the house of cards collapses. What they often forget is what comes afterward:

- Years of stagnation

- False starts

- And capital stuck in the wrong places while time keeps moving forward.

My research suggests the market may be setting up for a similar environment much sooner than most investors expect.

Let me explain…

Why the Next Lost Decade May Already Be Forming

You see, folks, the risk forming in today’s market is not a traditional crash.

There is no broad collapse underway. Prices are not breaking down. Most portfolios still look intact on the surface.

But my research indicates a potential Hidden Crash is heading our way in 2026. Not a sudden drop in stock prices, but a slowdown in earnings momentum across many of the largest and most widely held stocks in the market.

Earnings momentum matters because it drives long-term returns. When growth is accelerating, stocks tend to move higher. When that acceleration begins to fade, the returns flatten out. Over time, portfolios stagnate, making little to no meaningful progress.

So, why does this matter now? Well, market leadership has become increasingly narrow.

A relatively small group of mega-cap companies carries an outsized influence over portfolio performance. As those companies mature, sustaining rapid growth becomes more difficult.

Capital spending rises. Margins come under pressure. Incremental gains shrink.

Stock prices may hold up for a while. Some may even drift higher. But without strong earnings acceleration beneath the surface, returns can stall for years… even a whole Lost Decade.

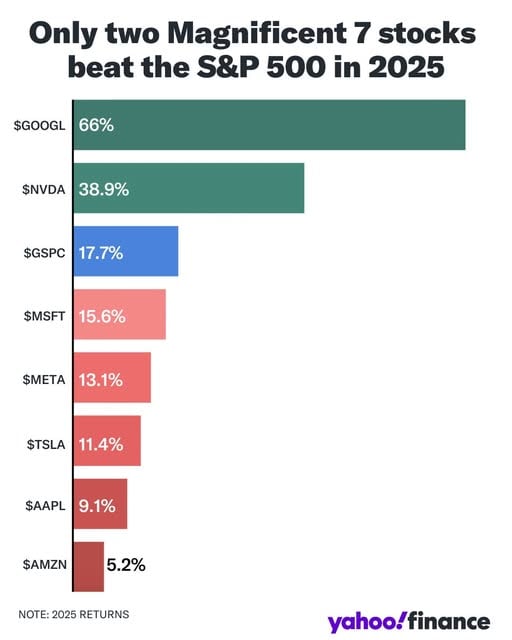

We are already seeing familiar signs. Growth is becoming more concentrated. A small group of mega-cap stocks dominates portfolios. Earnings acceleration is beginning to slow in some of those big names, even as investment spending continues to surge.

And just like last time, the biggest gains are unlikely to come from the stocks everyone already owns.

Let me be clear. I am not predicting that these companies will collapse. If history is any guide, many of them are more likely to become something else entirely.

Dead money.

Don’t think it can happen? I’ve got news for you – it already is…

The Real Risk of a Lost Decade Is Dead Money

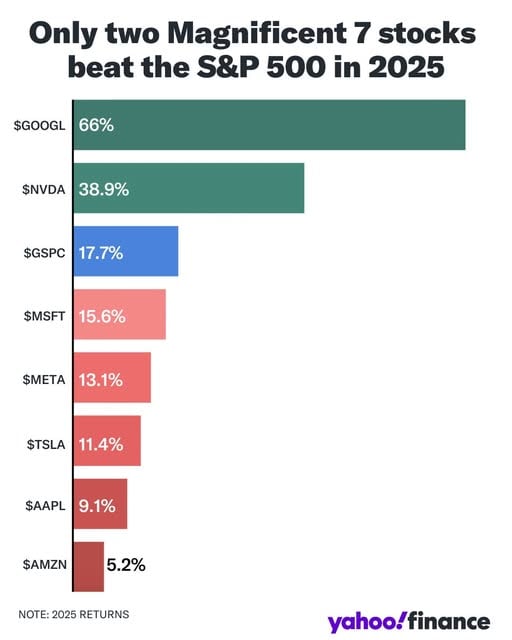

Take a look at the chart from Yahoo Finance below. It shows how, after years of strong gains, all but two of the Magnificent Seven have begun to lag the broader market.

Don’t get me wrong: The AI Revolution that propelled the Mag 7 to new highs is real. The risk isn’t AI – it’s assuming today’s leaders will remain tomorrow’s winners.

History shows this kind of environment can be just as damaging as a sharp decline. From 2000 to 2009, the market did not collapse and stay down. It simply went nowhere. Investors who remained fully exposed to stagnant leadership lost time they could never recover.

That is why this matters.

A hidden crash does not force decisions. It does not create urgency. It quietly traps capital in stocks that look stable, feel familiar, and fail to deliver.

Recognizing that risk early is the difference between staying stuck and staying in control.

Over the years, I’ve learned that navigating periods like this doesn’t require prediction or panic.

It requires a clear plan, like the one I tell you more about below…

A Blueprint for Surviving the Next Lost Decade

In my latest presentation, I’ve laid out what I call the Hidden Crash Blueprint, a simple three-step framework designed to help investors avoid stagnation and stay positioned for opportunity as market leadership shifts.

I walk through why this Hidden Crash is already forming, the specific signals my research is tracking as it develops, and what investors can do to prepare – and also profit.

While I can’t show you that full blueprint, here’s a brief rundown on how it works.

Step 1: Identify Stocks at Risk of Becoming Dead Money

The first step is identifying which stocks in your portfolio are quietly becoming dead money.

These are widely held companies where earnings momentum is slowing and future returns are becoming increasingly difficult to achieve. They may not collapse, but they can trap capital for years.

Before you can move forward, you need to know where the risk is. That’s why I’ve put together a list of 20 well-known companies I’ve identified that are on the edge.

My system is telling me they’re dead money right now – and you don’t want to be caught holding these stocks in 2026.

Step 2: Rotate Into the Next Market Leaders

Once stagnation is removed, the focus shifts to where growth is accelerating.

Capital leaving mature, overextended stocks does not disappear. It rotates into companies with improving fundamentals and expanding opportunities. This is where the next phase of market leadership emerges.

These innovators operate at the edges of major economic shifts – like the AI Revolution. They sit deep inside supply chains. They solve critical problems that the giants cannot efficiently handle themselves.

And in my new Hidden Crash 2026 broadcast, I explain how I identified five of these companies – and how they could deliver explosive gains as we enter 2026.

Step 3: Use a System to Track Earnings Momentum

Markets change. Leadership evolves.

The final step is to use a disciplined system to continuously monitor stocks, identify new opportunities as they arise, and recognize when conditions begin to weaken.

That’s where my Stock Grader system comes in.

It’s based on a framework I’ve relied on for decades to identify stocks transitioning from stagnation to acceleration.

And in 2025, we used it to make triple-digit gains on under-the-radar stocks like:

- Sezzle Inc. (SEZL) – 555.57%

- SPX Technologies Inc. (SPXC) – 119.77%

- M-tron Industries Inc. (MPTI) – 102.06%

- UFP Technologies Inc. (UFPT) – 98.05%

- Powell Industries Inc. (POWL) – 93.76%

- And more…

I suspect that nine out of 10 investors haven’t heard of these stocks. But these are the kinds of under-the-radar opportunities Stock Grader is designed to surface early.

It’s also why I’m sharing a deeper look at this Hidden Crash right now – before it shows up in the averages and before most investors realize what’s happening underneath the surface.

In this presentation, I walk through the specific warning signs my research is tracking, how to identify which stocks are becoming dead money – and how to find the hidden innovators that will deliver outsized returns while most investors are treading water.

If you want to understand where the real risk is forming – and how to stay in control as market leadership shifts – I encourage you to watch now while this window is still open.