Trump Turns on Musk: Stocks That Could Soar as Tesla and SpaceX Take a Hit

Editor’s Note: Illegal tariffs, steel taxes, court rulings… Now Trump and Musk going head-to-head in fiery spats on the world’s stage.

The headlines scream about skirmishes. But this week’s “Being Exponential” unpacks the noise to reveal the signal underneath…

Because while D.C. weighs tariffs, a much bigger transformation is unfolding at lightspeed: in the labs, factories, and data centers building the future.

We dissect the Q1 GDP pullback and why markets stalled – even as Nvidia (NVDA) posted jaw-dropping numbers. And we spotlight the tech megatrends you can’t afford to ignore: humanoid robots, quantum breakthroughs, and, yes, flying cars.

Forget the geopolitical tantrums. The bigger story is exponential: machines learning to reason, move, and fly.

If you’re hunting for the next 10x opportunity, this episode breaks down what matters, what doesn’t, and where the smart capital is heading next.

Listen now.

Not long ago, U.S. President Donald Trump and tech mogul Elon Musk were deep in their political honeymoon phase.

Trump was publicly praising Musk’s Tesla (TSLA). Musk was showing major support for Trump’s economic agenda, praising Trump-era tax reforms, advocating for reduced regulatory burdens, and emphasizing the importance of U.S.-based manufacturing.

Rumors even swirled about backroom deals: protection for EV subsidies, fast-tracked robotaxi launches, government contracts funneled toward SpaceX and Starlink.

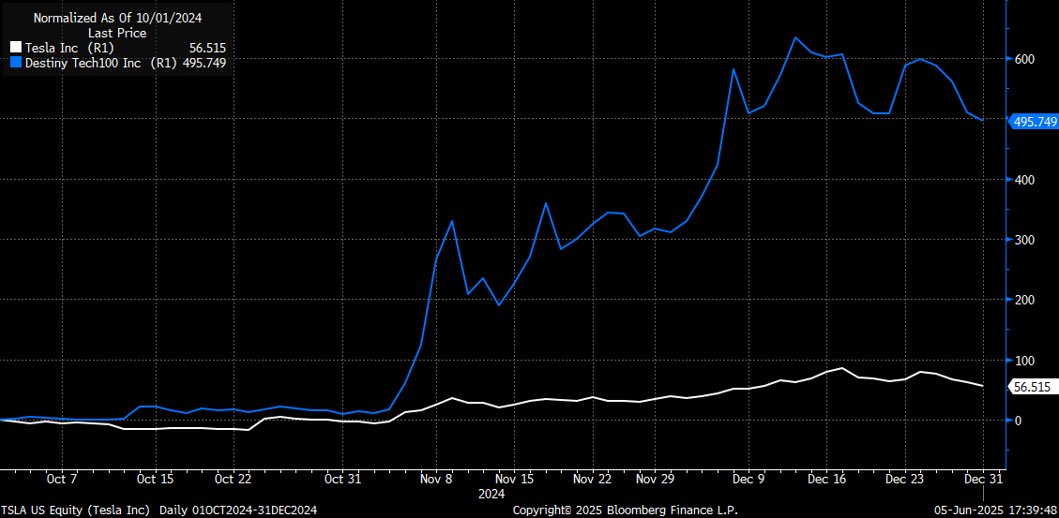

And investors took note. Tesla stock and the Destiny Tech100 (DXYZ) fund – an ETF with a stake in SpaceX – both surged.

But after this week’s fiery social media battle?

It seems likely that the bromance is over – bridges burned.

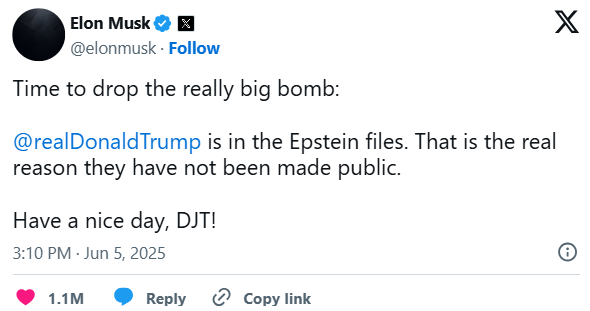

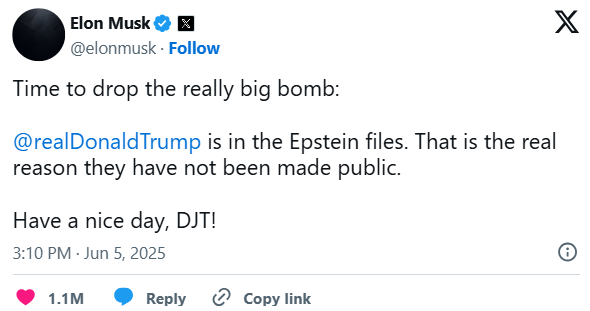

Trump and Musk have been trading public blows normally reserved for the worst of enemies. Trump has called Musk ‘ungrateful,’ saying he went ‘crazy’ and hinting at punitive action against his companies. Musk, meanwhile, is mocking Trump’s flagship bill, suggesting Trump is part of the Epstein files, and retweeting calls to impeach him.

This is a full-scale political divorce with billions of dollars in market cap hanging in the balance.

While the media focuses on the soap opera – and let’s be honest, it’s quite entertaining – we’re more concentrated on this fallout’s financial consequences…

Because this may be one of those rare moments when political chaos creates a powerful asymmetric investment opportunity.

Why Trump’s Turn on Musk Is a Big Deal for Investors

Given Trump’s first term was marked by aggressive deregulation, corporate tax cuts, and emphasis on American manufacturing, markets assumed that a second term would be good for Elon Musk.

That assumption powered massive gains in TSLA, as investors believed Trump would protect domestic EVs, fast-track robotaxis, and go soft on regulation. Similarly, DXYZ – the pre-IPO fund that holds SpaceX – soared on the idea that the president would keep feeding SpaceX juicy government launches and Starlink contracts.

But now that entire narrative is under siege. In fact, it has made a complete 180.

If Trump follows through on his social media threats against Musk – and history suggests he will – we could see:

- An EV subsidy rollback, which would tank margins across Tesla’s core product line

- Regulatory delays or legal action against Tesla’s robotaxi launch, especially in politically charged states like Texas or Florida

- A shift away from SpaceX in DoD and NASA launch contracts

- A freeze or reduction in Starlink’s government integration, particularly in defense and telecom resilience projects.

This assumption is based on plain pattern recognition. As we’ve seen many times before, Trump rewards loyalty and punishes dissent.

He’s issued pardons or commutations for loyalists like Roger Stone, Michael Flynn, Paul Manafort, and Steve Bannon, all of whom either refused to testify against him or stayed loyal despite legal trouble.

Often, he has elevated those known for personal loyalty over traditional qualifications, such as appointing Mark Meadows as Chief of Staff and Ric Grenell as acting Director of National Intelligence.

He has also dismissed people who have contradicted or criticized him openly, including James Comey of the FBI, Alexander Vindman of the NSC, and cybersecurity personnel Chris Krebs, who defended the integrity of the 2020 election.

Now Musk has publicly defected.

And Trump won’t respond lightly.

Which Stocks Could Win Amid This Political Divorce

So… what happens when the most dominant company in not one but two innovative industries – autonomous vehicles and commercial space – gets politically kneecapped?

Competitors rejoice.

And that’s where we see opportunity emerging. (Forget EVs; they’ll get bruised because Trump will likely kneecap the whole sector by removing subsidies entirely.)

The true winners are in AVs and space. That’s where Trump could personally hurt Tesla and SpaceX by giving competitors a leg up.

On that note, let’s talk AVs…

Musk has pinned Tesla’s future on autonomy. He wants all of the company’s vehicles to be fully self-driving. And further, he wants to launch a global autonomous robotaxi service within the next several years, making Tesla the epicenter of the Autonomous Vehicle Revolution.

That future requires regulatory approval…

More or less, it requires Trump’s blessing.

Autonomous cars can’t operate on roads with human cargo unless they have strong regulatory approval. And Trump can make it very difficult for Tesla to get that approval.

That would be a huge win for Tesla’s AV competitors, since many already have regulatory approval and are operating on roads across California, Texas, and Florida. If those firms keep growing and expanding while Tesla remains stymied in regulatory red tape, then those competitors could run away with the AV race…

Sidelined Tesla = Potential Breakaway Stars of the AV Revolution

Take Waymo, for example – owned by Alphabet (GOOGL).

It already has a fully operational robotaxi service in cities like San Francisco, Los Angeles, Phoenix, and Austin, delivering over 250,000 rides per week. And it’s looking to expand to cities like Miami, Atlanta, D.C., and San Diego this year.

Tesla was supposed to be its biggest competition in the robotaxi game. But if Tesla is cut down at the knees, Waymo could easily cement itself as the immovable robotaxi leader.

Uber (UBER) is in a similar situation.

It has partnered with Waymo and other self-driving startups to deliver robotaxi rides through its ridesharing network. As such, it seems likely that the majority of autonomous vehicle firms will partner with Uber to deliver rides – except for Tesla. But if Tesla’s robotaxi program stays sidelined, Uber will remain a front runner.

We think Aurora (AUR) could win here, too. We see it as a pure-play autonomous driving company that is focused on trucking and logistics. Perhaps less sexy than robotaxis but potentially more important – especially to an administration that loves U.S. manufacturing, infrastructure, and defense.

Aurora is small and under-the-radar. And we think that if Trump wanted to really piss Musk off by endorsing another AV firm, it’s perfectly positioned for a spotlight moment.

Space Stocks to Watch If Trump Defunds SpaceX

Then there’s the space angle.

Musk’s SpaceX does a lot of business with the U.S. government. It’s NASA’s primary partner for transporting astronauts to the International Space Station (ISS) and has also completed over 25 missions delivering supplies to the ISS. And according to Texas Standard, it holds contracts with the U.S. military to launch satellites into orbit for national security purposes (worth approximately $6 billion), making it the Pentagon’s top launch provider into the 2030s.

If Trump decides he wants to shift some contracts and/or emphasize doing business with other space firms going forward, that would be a huge loss for SpaceX – and a huge win for its competitors.

The biggest direct competitor? RocketLab (RKLB).

It handles smaller rockets with smaller payloads, but it’s previously done lots of work for the U.S. government before and is a very credible, respected player in this space. If Trump wants to diversify away from SpaceX, I’d imagine that RocketLab would be his first phone call.

Another big winner here could be AST SpaceMobile (ASTS), which, alongside Amazon’s Project Kupier, is one of two of Starlink’s competitors in the satellite-to-smartphone game. But in our view, Project Kupier is too small to move the needle for Amazon stock, so ASTS is the play here.

It’s working to launch a satellite constellation that delivers direct-to-device cell coverage, eliminating dead zones by connecting users in planes, remote areas, even during natural disasters.

In the coming months, Trump could shift some government support away from Starlink and toward AST – a move that could send ASTS stock sharply higher.

Trump vs. Musk May Be Drama, But It’s Also a Huge Investing Signal

Right now, everyone is eating up the Trump-Musk feud with a fork and knife. And we don’t blame them.

But at the same time, it’s important not to miss the forest for the trees here. The market is already repricing risk amid this social media circus; and we think there is some major profit potential quickly emerging. You don’t want to miss the boat with this one…

Consider this: Tesla’s robotaxi rollout, scheduled for next week, is now in limbo. And SpaceX’s government contract pipeline is stuck under review.

Once a golden ally of Trump 2.0, Elon Musk is being publicly sidelined.

It’s the kind of chaos that generational investment opportunities are made from.

That being said, there’s still one part of Tesla’s business that we’re confident will remain unimpacted.

In fact, it’s arguably the most exciting investment opportunity in the market right now.

Learn more about the sector that Morgan Stanley believes could become a $30 trillion market over the next few decades.